How to evaluate the potential of an investment in shares? We explain the discounted cash flow (DCF) method

Published by: 15.07.2021 09:31:39Would you like to invest in stocks but don't know how to calculate future company profits? We've selected one method of stock picking for you.

What does DCF mean?

What does DCF mean?

The discounted cash flow or discounted cash flow model is arguably the most widely used absolute valuation or valuation model for estimating the intrinsic fundamental value of an asset. It is not complex in principle; we calculate the intrinsic value of an equity company by the sum of the expected future cashflows generated by the company, but discounted as of the valuation date.

Who is this article for?

With this article, we would like to share a method that is commonly used in the investment world, especially when investing in US stock market titles. Using the DCF method, we calculate the value of the stocks we plan to include in our portfolio. Thus, this method is particularly suitable for investors looking for companies with interesting value growth potential. It is important to mention that we take into account many more criteria before choosing a title to invest in, see. "our strategy".

How does this method help me?

This method allows an investor to calculate the approximate value of the future cash flows of any public company. The accuracy of future cash flows depends on the company's growth estimate (e.g. 20% Y/Y). The slightest variation in the company's real growth dramatically reduces the accuracy of the DCF model.

What does the DCF method consist of?

The formula for calculating DCF may seem complicated at first, but once you have calculated a few companies you will get used to it and just plug in the values in a fairly straightforward way. We calculate the value of a business corporation based on projected free cash flow, which we define as the difference between operating cash flow and net working capital additions.

For the calculation, it is necessary to prepare the following values:

- Future revenue growth, expressed as a percentage

- Discount rate - cost of capital (WACC)

- FCFF (free cash flow ratio)

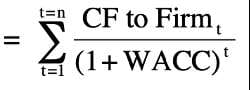

Calculation formula for DCF

The value of the firm is obtained by discounting the expected cash flows to the firm, i.e. free cash flows after all operating expenses and taxes but before debt repayments, at a weighted average cost of capital, which is the cost of the various components of financing used by the firm, weighted by their shares of market value.

Advantages and disadvantages of the DCF method

+ probably the most accurate method for valuing firms

- even a small change in a company's projected growth results in a large change in the bottom line

- it is necessary to know the future plans of companies

Glossary of terms

Cashflow - cash flow, or the difference between a company's cash flow receipts and cash flow disbursements

WACC - Weighted average cost of capital

FCFF - Free Cash Flow to Firm (FCFF = EBITDA - Tax rate x EBIT - Change in net working capital - CAPEX - M&A expenses)

Discount Rate - Cost of Invested Capital

Documents to download

K&L Rock also declares that it is not liable for any direct or indirect damage resulting from trading on the capital markets in general, and posts in discussions expressing the views of readers may not be in line with the operator's position and therefore cannot be regarded as its views.