REIT: Investing in real estate simply and without worries

Published by: 17.12.2024 11:40:10Real estate has long been considered one of the most stable investments. However, not everyone has the opportunity to own an apartment, house or commercial building, let alone manage and rent it out. However, if you are interested in investing in real estate, there is a smart and affordable way to do so without high entry costs and the need for management. This path is through real estate investment trusts, known as REITs.

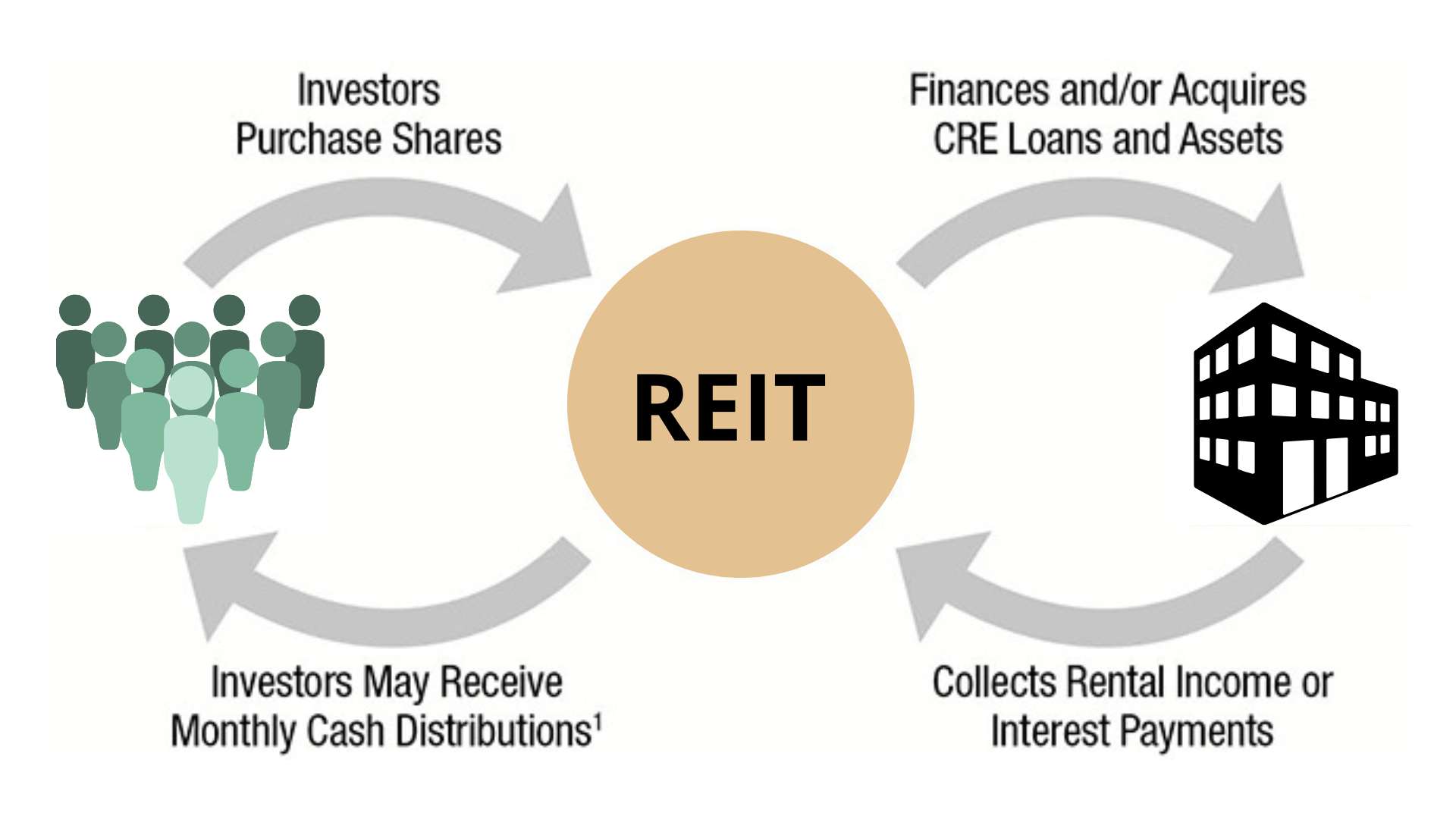

A REIT operates as a company that invests in income-generating properties. These real estate assets can include office buildings, shopping malls, apartment complexes, warehouses or healthcare facilities. REITs collect funds from investors, manage the properties and share profits in the form of regular dividends. The shares of these companies are traded on exchanges, which means that to invest, all you need to do is open a brokerage account and decide which REIT to invest in.

One of the main attractions of REITs is regular passive income. These companies are required to pay out most of their profits to shareholders, often in the form of large dividends. This is a great advantage for investors looking for a steady income. They also allow for portfolio diversification – instead of investing in a single property, you can own a share of an entire portfolio that can include different types of properties across geographical areas.

In addition to simplicity, REITs also offer flexibility. Unlike direct property ownership, which is often associated with high costs and low liquidity, REIT shares can be easily bought and sold. This makes them an accessible investment vehicle even for those who do not have a large amount of capital.

There are different types of REITs, which differ in their focus. The most common type are the so-called equity REITs, which own and operate real estate. These companies’ profits come mainly from rentals. There are also mortgage REITs, which focus on financing real estate through mortgage loans, and hybrid REITs, which combine both approaches.

Despite their advantages, REITs carry certain risks. One of them is sensitivity to interest rates. When interest rates rise, this can negatively impact the value of REIT shares, especially those focused on mortgage financing. Another risk is market volatility – the value of a REIT can change depending on economic conditions or the development of a specific real estate sector, such as hotels or shopping malls.

Investing in REITs can be a great option if you are looking for easy access to the real estate market and want to diversify your portfolio. However, before buying, it is important to have a good understanding of each type of REIT, conduct analysis and evaluate how they fit into your investment strategy. Investing in REITs does not require millions of crowns or expertise in the real estate market. It is a tool that offers a simple and effective way to benefit from real estate income – without the hassle, high costs and time demands.

Documents to download

K&L Rock also declares that it is not liable for any direct or indirect damage resulting from trading on the capital markets in general, and posts in discussions expressing the views of readers may not be in line with the operator's position and therefore cannot be regarded as its views.